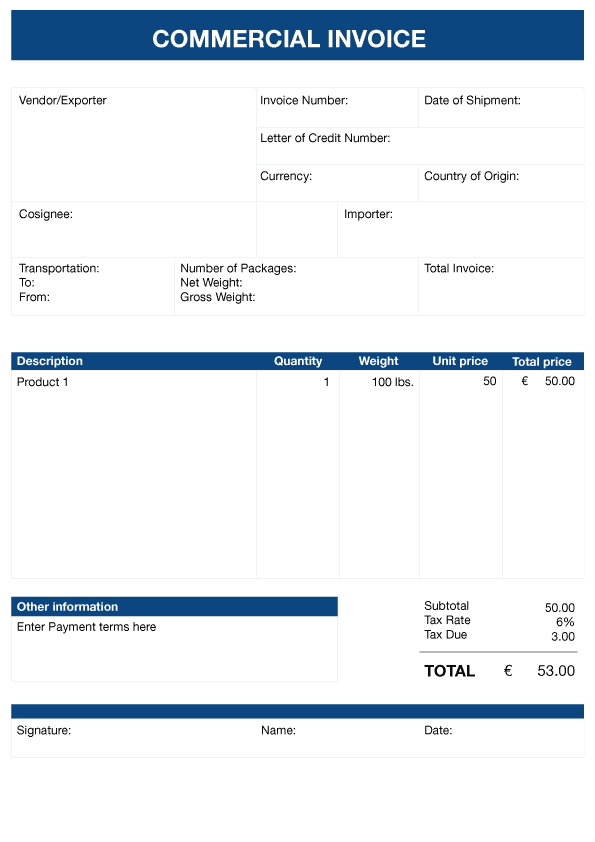

The commercial invoice is a legal document between the supplier and the customer that clearly describes’ the sold goods, and the amount due on the customer. The commercial invoice is one of the main documents used by customs in determining customs duties.

For U.S customs requirement, Commercial invoice must contain below information Base on 19 CFR 141.86

(1) The port of entry to which the merchandise is destined;

(2) The time when, the place where, and the person by whom and the person to whom the merchandise is sold or agreed to be sold, or if to be imported otherwise than in pursuance of a purchase, the place from which shipped, the time when and the person to whom and the person by whom it is shipped;

(3) A detailed description of the merchandise, including the name by which each item is known, the grade or quality, and the marks, numbers, and symbols under which sold by the seller or manufacturer to the trade in the country of exportation, together with the marks and numbers of the packages in which the merchandise is packed;

(4) The quantities in the weights and measures of the country or place from which the merchandise is shipped, or in the weights and measures of the United States;

(5) The purchase price of each item in the currency of the purchase, if the merchandise is shipped in pursuance of a purchase or an agreement to purchase;

(6) If the merchandise is shipped otherwise than in pursuance of a purchase or an agreement to purchase, the value for each item, in the currency in which the transactions are usually made, or, in the absence of such value, the price in such currency that the manufacturer, seller, shipper, or owner would have received, or was willing to receive, for such merchandise if sold in the ordinary course of trade and in the usual wholesale quantities in the country of exportation;

(7) The kind of currency, whether gold, silver, or paper;

(8) All charges upon the merchandise itemized by name and amount, including freight, insurance, commission, cases, containers, coverings, and cost of packing; and if not included above, all charges, costs, and expenses incurred in bringing the merchandise from alongside the carrier at the port of exportation in the country of exportation and placing it alongside the carrier at the first United States port of entry The cost of packing, cases, containers, and inland freight to the port of exportation need not be itemized by amount if included in the invoice price, and so identified. Where the required information does not appear on the invoice as originally prepared, it must be shown on an attachment to the invoice;

(9) All rebates, drawbacks, and bounties, separately itemized, allowed upon the exportation of the merchandise;

(10) The country of origin of the merchandise; and,

(11) All goods or services furnished for the production of the merchandise (e.g., assists such as dies, molds, tools, engineering work) not included in the invoice price. However, goods or services furnished in the United States are excluded. Annual reports for goods and services, when approved by the Center director , will be accepted as proof that the goods or services were provided.